county tax liens nj

In fact the rate of return on property tax liens investments in Bergen County NJ can be anywhere between 15 and 25 interest. Should any member of the public wish to attendlisten to the board meeting the call in number is 201-336-6626 and the access code is 8809.

Its purpose is to give official notice that liens or judgments exist.

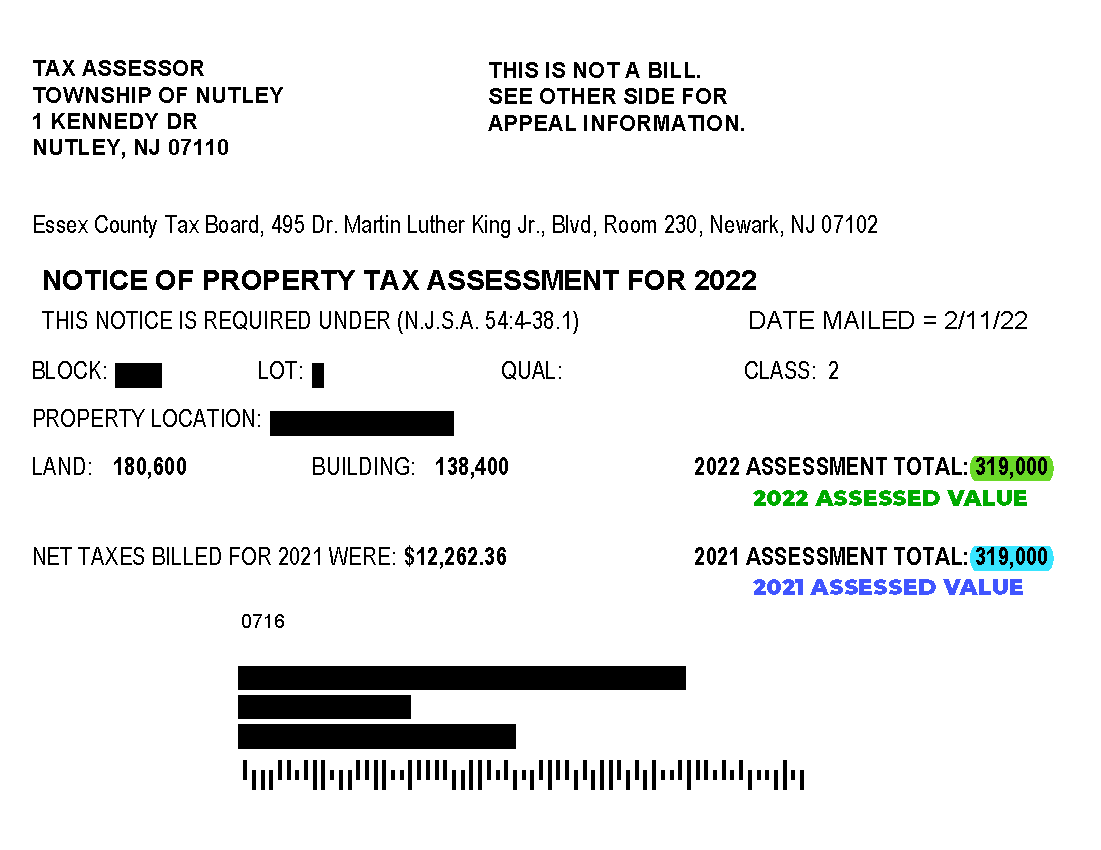

. Ad Property Liens Info. IRS Liens StateCountyCity Tax Liens Mechanics Liens HOA Liens. Essex County Tax Board 495 Dr.

Find All The Assessment Information You Need Here. This includes deeds mortgages liens judgements lis pendens discharges notices. Division of Taxation HotelMotel Tax and Fee Information Return Period.

Interest Rate andor Penalty Rate. Search Any Address 2. A tax lien is filed against you with the Clerk of the New Jersey Superior Court.

All Mail Meetings Hearings will be held at the new location. Typically there are municipality taxes on properties lands water sewer charges and electricity. CODs are filed to secure tax debt and to protect the interests of all taxpayers.

Ad Search Information On Liens Possible Owners Location Estimated Value Comps More. In order to comply with the Open Public Meetings Act the Bergen County Board of Taxation will hold their June 1st Board Meeting 930 am via teleconference call. Tax Lien Certificates Sec.

A tax lien in New Jersey is a statutory lien that arises due to delinquent taxes. In New Jersey county treasurers and tax collectors sell tax lien certificates to the winning bidder at the delinquent property tax sale. Since 1675 the Monmouth County Clerk has been responsible for maintaining a record of real property transfers and interests in the County.

18 per annum and 4 6 penalty. Find all Liens and Judgments recorded on a Property andor Owner. See Available Property Records Liens Owner Info More.

In fact the rate of return on property tax liens investments in Cape May County NJ can be anywhere between 15 and 25 interest. Burlington County NJ currently has 7572 tax liens available as of August 18. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Burlington County NJ at tax lien auctions or online distressed asset sales.

Failure to pay taxes leads to the assessment of a continuous lien on such properties. Investing in tax liens in Bergen County NJ is one of the least publicized but safest ways to make money in real estate. Unsure Of The Value Of Your Property.

June 1 2022 - June 30 2022 COUNTY NAME CODE TOTAL STATE FEE TOTAL MUNI TAX TOTAL STATEMUNI ATLANTIC COUNTY 1 69811250 19947922 89759172 BERGEN COUNTY 2 128346408 76987571 205333979 BURLINGTON COUNTY 3 55030935. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus. State of New Jersey.

Martin Luther King Jr Blvd Room 230 Newark NJ 07102 Together we make Essex County work. Investing in tax liens in Cape May County NJ is one of the least publicized but safest ways to make money in real estate. Please know our phone fax numbers have not changed.

2022 Tax Appeal Deliberations. A judgment entered in court that is available for public view.

You Can Now Pay Property Taxes Online Orange City Council

3 Birch Ter Stainless Appliances Cabinetry Estate Sale

Understanding Nj Tax Lien Foreclosure Westmarq

Bid4assets Com Online Real Estate Auctions County Tax Sale Auctions Government Auctions Online Taxes Dream Big Real Estate

New Jersey Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver Bill Of Sale Template Bill Of Sale Car Templates

How Much Money You Need To Save To Retire Early In Every U S State Vivid Maps Life Map Retirement Financial Literacy Lessons

Township Of Nutley New Jersey Property Tax Calculator

These Are The States Where 100 Goes The Farthest Map Cost Of Living Infographic

The Official Website Of The City Of South Amboy Nj Tax Collection

Township Of Nutley New Jersey Property Tax Calculator

New Jersey Sales Tax Holiday On Back To School Supplies To Take Effect At Summer S End Phillyvoice